Promissory note amortization schedule

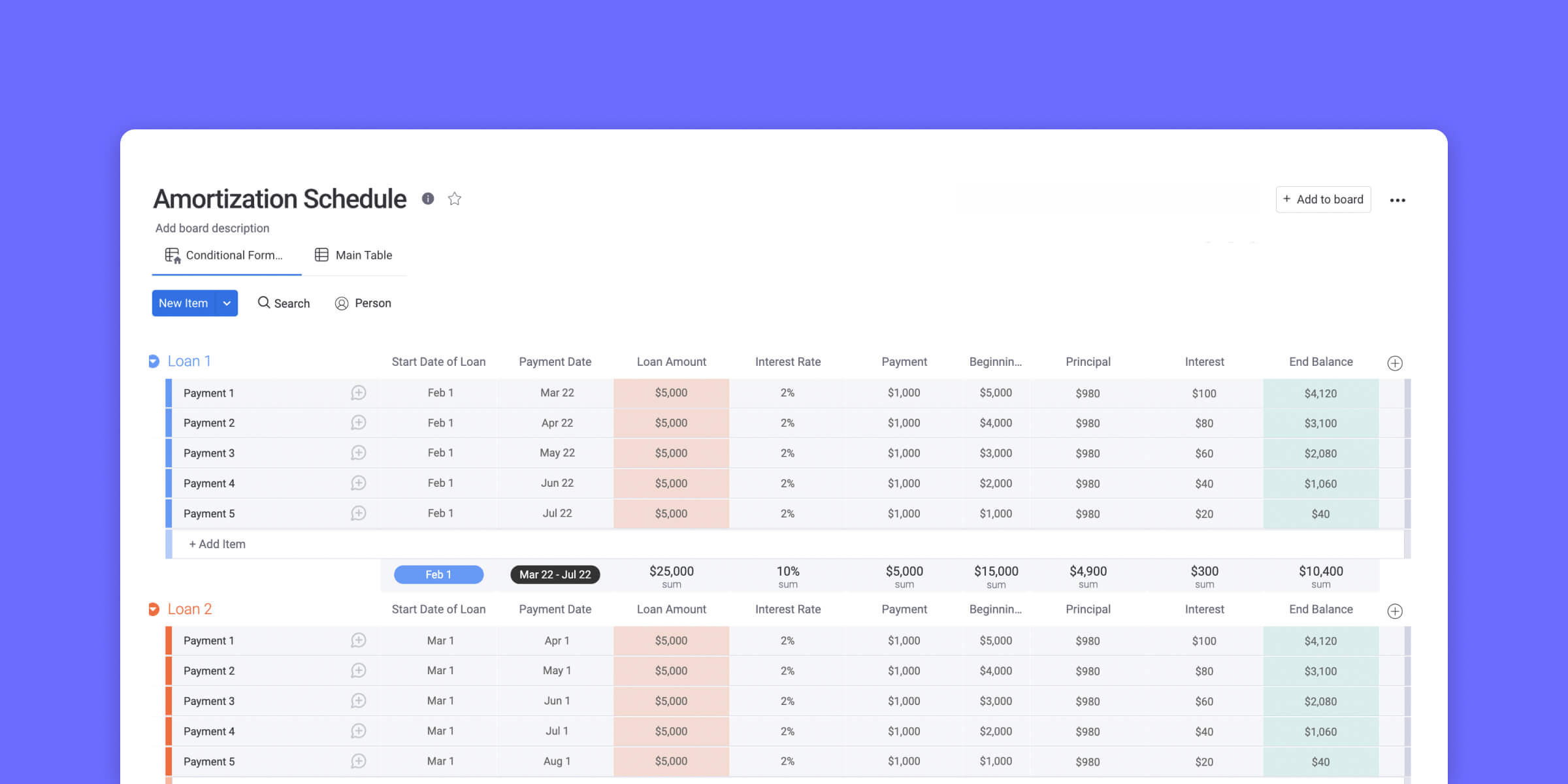

Still offers the ability to sell the promissory note to an investor for an up-front payment. An Amortization Schedule is a loan payment calculator that helps you keep track of loan payments and accumulated interest.

Definition Of Promissory Note Chegg Com

306 truth in lending act disclosure requirement.

. Real Estate ABC - Information on Buying and Selling A Home Interest Rate Report - Jul 2015. Schedule D Form 1040. Corrective Action Plan Templates.

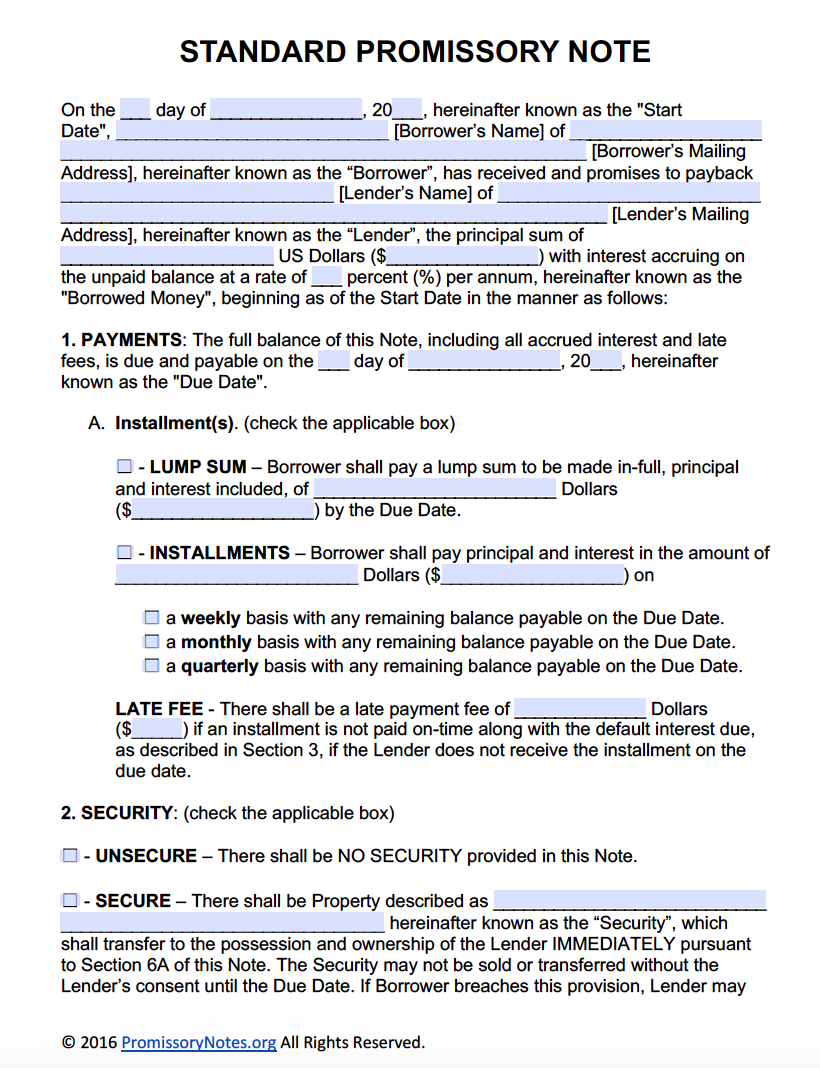

304 past due accounts and non-performing loans. In this case the buyer issues a promissory note to the seller that it agrees to repay amortize over fixed period of time. Our Promissory Note template will customize your document specifically for the laws of your location.

Select the state where the loan is taking place. Loan term and amortization schedule. 312 credit card.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. Series EE bonds issued in 1991 matured in 2021. Amortization schedules and other details pertinent to that loan agreement.

This is when other parties including the employer if the borrower is involved in paying the loan. Sometimes referred to as payment processing float or internal float but since some of the sources of the float delay are not necessarily internal the term internal float is not a completely. Depreciation and amortization.

LawDepots Amortization Schedule lets you outline how the borrower makes loan payments such as a one-time lump sum payment at the end of the term including accumulated interest or regularly scheduled payments such as bi-weekly or. Rental forms tenant applications lease agreements move inout checklists more. Use a Promissory Note to detail the terms of loan repayment.

The person assignee who receives a. A promissory note is used for mortgages student loans car loans business loans and personal loans between family and friends. AAOA has all the landlord resources to make property management easy.

In the United States a mortgage note also known as a real estate lien note borrowers note is a promissory note secured by a specified mortgage loan. In a mortgage note templates examples the borrower is allowed to lend a certain amount of money from a lending company eg. According to the promissory note this is comprised of 10200 in principal repayment and 27200 in interest.

On the December 2011 balance sheet the 10200 that is principal due in the next 12 months will be the loan payable current portion. Newton would have preferred a 30-year amortization schedule since that would divide his payments up more give him a lower monthly payment and improve his cash flow on the investment property. To transfer to another person any asset such as real property or a valuable right such as a contract or promissory note.

Describe the relationship between the lender and the borrower eg friend or family member. If you have used method 1 you generally must report the interest on these bonds on your 2021 return. One way to pay off your car loan early is to make one lump payment.

A promissory note to be paid in installments with a final balloon payment made at the end of the agreed repayment schedule. 54 Amortization of intangible assets 95. There are two main categories of promissory notes.

Inducement loss on sale of liability. A Promissory note is a. Learn how to easily convert an Adobe PDF file to a Microsoft Word fileI use Microsoft Word that comes with Office 365 to do the conversion.

A Overview - 1 In general. Bad debt expense 134. Recent loan statements or record of payments.

Download a free template here Step-by-step builder PDF Word format. The full amount is due on that date and there is no payment schedule involved. The loan term is the amount of time a buyer has to pay back.

When a Loan Policy is to be issued insuring the lien securing a variable rate mortgage loan note the company may attach to the Loan Policy the Variable Rate Mortgage Endorsement or the Variable Rate Mortgage-Negative Amortization Endorsement Form T-331 upon payment of any premium prescribed by Rate Rule R-11d. Amortization schedules and other. 303 secured loans and other credit accommodations.

Types of loans and credits. 305 interest and other charges. Pay Stub Paycheck Stub Templates.

Long-term mortgage interest rates continued their move to record highs for 2015 according to data from mortgage finance company Freddie Mac. In the US the Federal government created several programs or government sponsored. While the mortgage deed or contract itself hypothecates or imposes a lien on the title.

There may or may not be interest charged on the loan amount depending on what youve agreed. A mortgage also known as mortgage loan or home loan is a loan intended to purchase a property usually a house. A business loan agreement especially when the borrowed money is supplementing or starting a business.

Mortgage notes are a written promise to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise. The sellers note is attractive to the financial buyer because it is generally cheaper than other forms of junior debt and easier to negotiate terms with the seller than a bank or other investors. Section 197 allows an amortization deduction for the capitalized costs of an amortizable section 197 intangible and prohibits any other depreciation or amortization with respect to that propertyParagraphs and of this section provide rules and definitions for determining whether property is a section 197 intangible and paragraphs and of.

Be repaid by December 1. 311 salary-based general-purpose consumption loans. Gain on extinguishment of debt PPP loan 3612 Change in fair value of common stock warrant liability 11735 2220.

302 amortization on loans and other credit accommodations. Include the names and addresses of all lenders and borrowers. Promise to Pay or Promissory Note.

With a simple promissory note the full amount of 1000 is due on that date with no payment schedule involved. Once you weigh out the benefits and drawbacks you can decide whether its a good idea to pay off your car loan early. Inventory write-off 697.

Bank and the property heshe purchases with the money serves as a collateral. Note that its basic elements are present whether the work is done by the owner of the funds or the work is done by a bank or other lockbox vendor. A periodic payment plan to pay a debt in which the interest and a portion of the principal are included in each payment by an established mathematical formula.

Schedule B Form 1040 Interest and Ordinary Dividends. If you decide it makes sense for you youve got a couple options for paying off your loan ahead of schedule. The contract lasts for a specified period of time.

For other information on. See Bond Premium Amortization in chapter 3. Impairment of assets held for sale.

The loan agreement is sometimes referred to as. The difference is a premium. So in a loan of 5000 the borrower could make monthly payments of 500 for six.

Notes Payable Principlesofaccounting Com

Free Interest Only Loan Calculator For Excel

Amortization Schedule Notes Payable Amortization Table Creation Youtube

Pin On Business Template

Promissory Note What Is An Iou With Examples Adobe Sign

Budgeting Can Be As Easy Or As Difficult As You Make It Preparing A Monthly Budget Has Multiple Advantages Salary Calculator Calculator Amortization Schedule

Easy To Use Amortization Schedule Excel Template Monday Com Blog

Free Promissory Note Template Adobe Pdf Microsoft Word Promissory Notes Promissory Notes

Loan Payment Schedule Amortization Schedule Loan Repayment Schedule Schedule Template

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

Amortization Schedule Create Accurate Payment Schedules

Printable Mortgage Calculator In Microsoft Excel Mortgage Payment Calculator Mortgage Calculator Mortgage Payment

Long Term Loan Agreement Template Cash Loans Personal Loans Business Loans

Notes Receivable Amortization Schedule Calculated With Accounting Journal Entries Youtube

What Is Loan Definition Type Advantage Disadvantage Part 2 Secured Loans See Additiona Loan Secured Loan Definitions

Best Direct Deposit Authorization Form Templates Word Directions Words Templates

Budgeting Can Be As Easy Or As Difficult As You Make It Preparing A Monthly Budget Has Multiple Advantages Salary Calculator Calculator Amortization Schedule