Debt recovery interest calculator

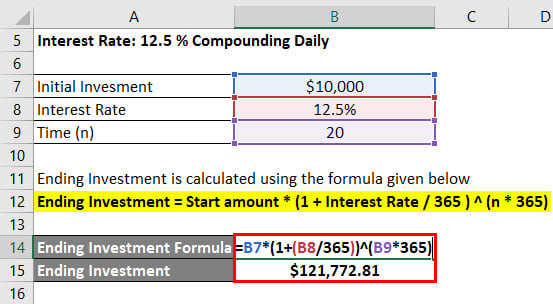

3 25 4 33. Derek would like to borrow 100 usually called the principal from the bank for one year.

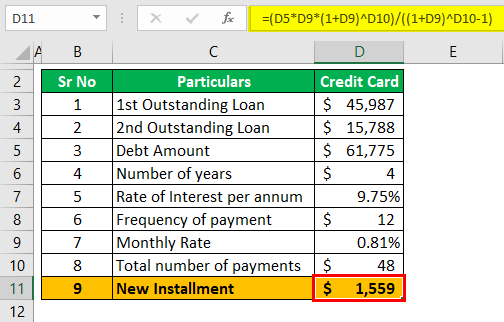

Debt Consolidation Calculator How To Consolidate Your Loans

Here A means the amount to be paid.

. The debt avalanche method on the other hand focuses on paying off your debt with the highest interest rate first. Besides the interest rate the loan fees or points are major costs of a loan. P is the principal amount that you.

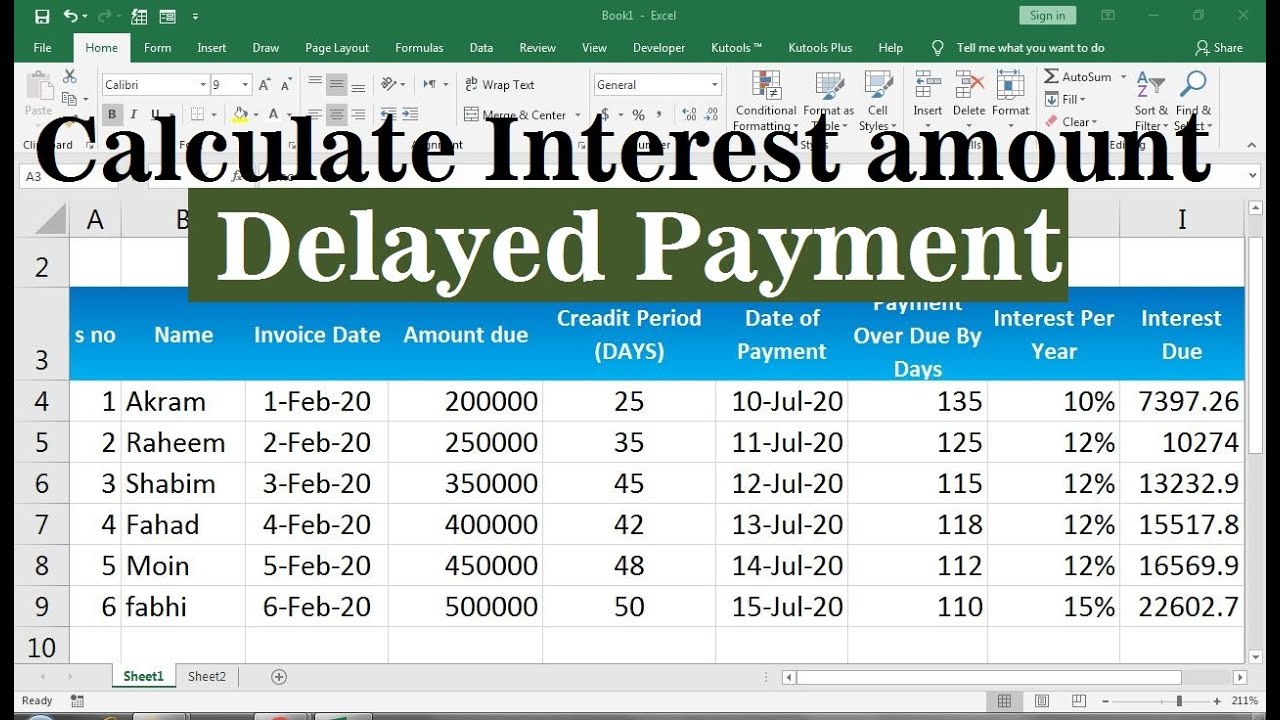

In 5 minutes or less you can discover how ConServe can increase the percentage you recover for every dollar you spend. We advise you to specify the reminder costs in your general terms and conditions in advance. Calculate how much late payment interest you can charge when your customers pay beyond.

Maximize your returns today. Please refer to the FAQ for. We hope you like it.

Thus the interest of the second year would come out to. Try out ConServes free ROI calculator. Choose the State and Court Jurisdiction.

The following is a basic example of how interest works. We are exercising our statutory right to claim interest at 8. 15 over 200- 30- but this is below the minimum so the minimum is calculated and the.

110 10 1. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. Our advice is to include at least 15 costs with a.

To calculate the late payment interest due on your overdue invoice please input the date that the invoice was due for payment. Because the purpose of debt consolidation is to lower the costs of debts any additional fees on top are not helpful. The bank wants 10 interest on it.

Late payment costs for business debtors. Use this simple calculator to get a sense of how much money the interest on your loans and lines of credit can cost you over time. You should use this calculator if interest charged on overdue debt is defined in your terms of business and differs from that in the UK Late.

The VIC Penalty Interest Calculator makes it simple to work out the interest owed. It allows you to calculate the total amount owed including interest on a given end date for the debt if paid by a single payment on that end date or by instalments. All aspects of your service standards exceed expectations.

Interest is calculated by the following formula. It covers multiple interest rates and is free to use. This is an interest and debt recovery fee calculator for UK businesses with commercial debt.

1 For a claim with a principal sum of 200- the collection costs are. Contractual Interest Late Payment Calculator. Use our simple interest calculator to calculate the interest due on a debt you are owed.

J. Its free to use quick and we think it looks nice too. Simply call 0800 9774848 to discuss your requirements with one of our debt recovery experts.

This way youll reduce the total amount of interest you pay on your debt over. Ad 10000-125000 Debt See If You Qualify for Debt Relief Without a Loan. A P 1 rt This formula might seem perplexing but it is very simple.

Excel Formula Calculate Interest For Given Period Exceljet

Home Loan Emi Calculator 2022 Free Excel Sheet Stable Investor

Late Payment Interest Calculator Excel Youtube

Online Debt Interest Calculator

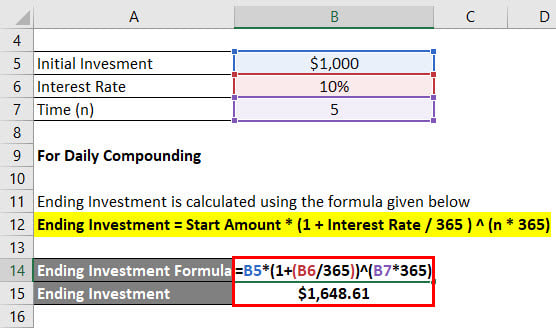

Daily Compound Interest Formula Calculator Excel Template

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Amortizing Loan Calculator Calculate Interest Rate Accessbank

Debt Repayment Calculator Credit Karma

Easiest Irs Interest Calculator With Monthly Calculation

Schedule Loan Repayments With Excel Formulas

Simple Interest Calculator Audit Interest Paid Or Received

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

What Is The Formula To Calculate The Interest Rate For A Home Loan Personal Loan Etc Quora

Loan Repayment Calculator

How Can I Calculate Compounding Interest On A Loan In Excel